How will we express creativity in the digital age?

Follow Larriyah’s creative journey through the art studio and game design labs at Clark, to a career path at Amazon.

The Clark Experience prepares students to be creative, imaginative, and bold thinkers who are ready to challenge convention and change our world.

With academic excellence at its core, The Clark Experience is our promise to every student that they will have the opportunity to excel academically, discover their purpose, explore their passions, cultivate their communities, engage locally and globally, and know that they are prepared for a fulfilling career and life.

It’s no wonder 96% of Clark graduates say they’re doing meaningful work.

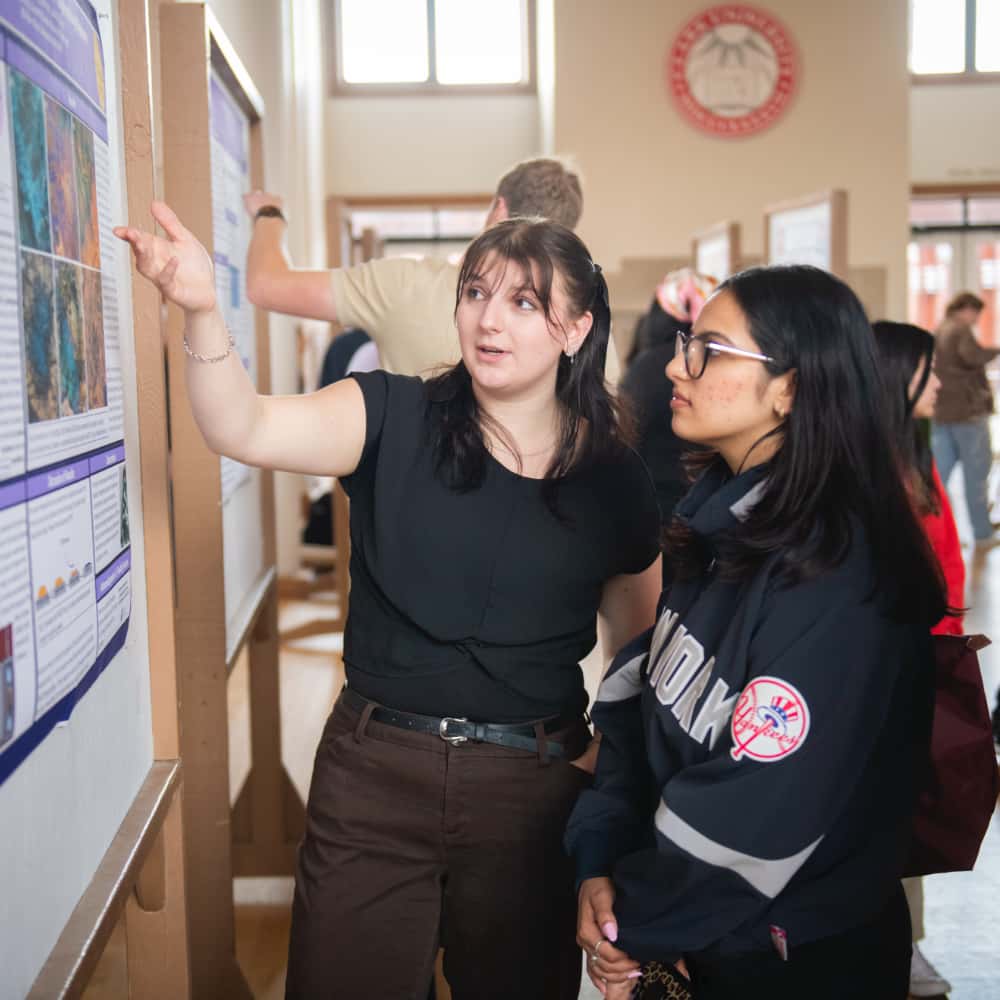

At ClarkFest, students share their research, academic achievements, and creative works through posters, presentations, and interactive exhibits.

International Gala 2025

International Gala 2025 filled the Kneller Athletic Center with an explosion of color, movement, and fashion.

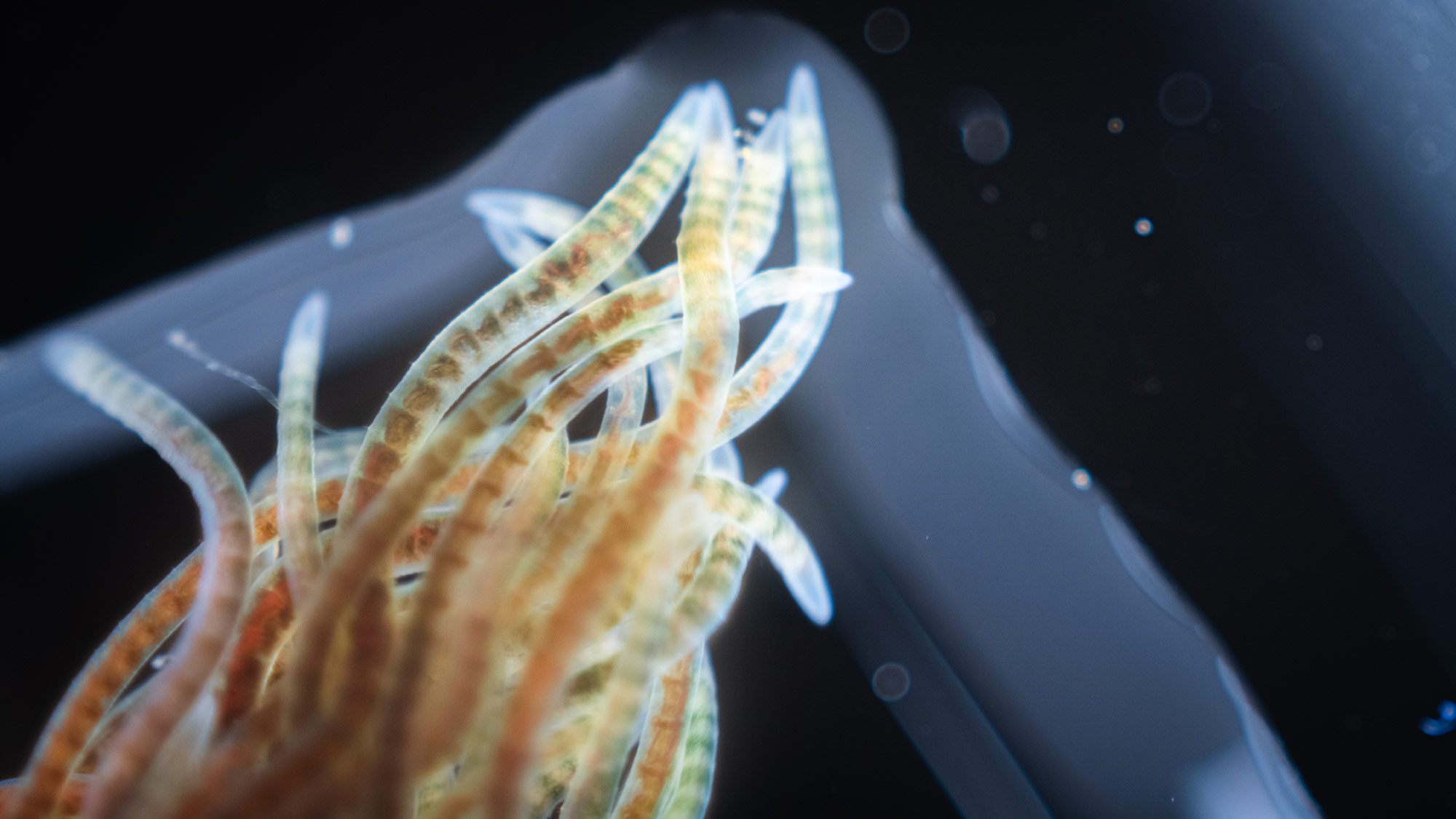

How sound is changing the planet

As Professor Matt Malsky teaches his students about soundscapes and acoustic ecology — one of his classes includes a walking tour around Worcester to absorb all the noises of nature and traffic — he’s also thinking about the intersection of sound and our changing climate.

Academics

Majors, minors, and concentrations.

of students complete an internship or experiential learning.

First-year students receive need-based financial aid

Student-to-faculty ratio in the classroom